Transitioning from military to civilian life can be both an exciting and overwhelming feeling, especially if that’s all you’ve known your entire adult life. Luckily, there are programs upon programs, educational resources, and much more dedicated to helping you make that transition as smooth as possible. So, while you’re doing your research about life after the military, why not take a look at life insurance too. Let us help you understand the ins and outs of life insurance by answer some of your biggest questions, starting with: What is VGLI?

Life Insurance after the Military

When you’re getting out of the military, suddenly all the things that made life easier seem so much more difficult, and now you’re worried about all the basic necessities the military has been giving you. How will I support myself? How will I support my family? Should I go back to school? How do I get health insurance? How do I find a new job? Will I find purpose again? Will I make it in the civilian world? All of these questions are enough to make even the most level-headed and prepared individual a little bit queasy, which we can all understand.

With that being said, most of us know that the VA can help us with our healthcare and our education; what you might not know is, they also have an option for life insurance. But that still leaves many questions, such as: do I actually need life insurance coverage?

The answer is, it depends—which we will cover shortly—When you get out of the military, you have 120 days to find new life insurance because this is how long after your separation date that you are covered under SGLI. And up until that point, chances are, you didn’t have any concerns about it because it was just something you signed up for when you joined. But things have changed, you’re getting out, and you have to seek things like healthcare and life insurance on your own, which if you joined at 18, right out of high school, you might not know where to start.

The good news is you have options; bad news; you have an overwhelming number of companies to choose from. However, finding life insurance for veterans may come with a little more difficulty, which is where VGLI might become beneficial.

What is VGLI

Veterans Group Life Insurance is an option all veterans who were discharged under anything other than dishonorable have an option obtaining. If you used SGLI—which chances are high you did—then you are eligible. However, if, for some reason, you did not have coverage under SGLI, then you would not qualify for VGLI. For veterans that do qualify, when you initially sign-up for coverage, you can only select up to the same amount of coverage you had under SGLI.

For example, let’s say you had $200,000 worth of coverage under SGLI. When you get out of the military, if you elect VGLI for your coverage, you can only get up to $200,000 coverage. However, once 5-years have passed, you can increase your coverage by $25,000, and so on for every 5-years after, for a maximum amount of $400,000.

You also have the option of selecting less coverage under the VGLI plan compared to what you had with SGLI but in increments of $10,000.

Do I need Life Insurance?

Unlike health insurance, life insurance is not for everyone because not everyone needs it, which leads to your question, “Do I need life insurance?” The answer truly depends on you. There may be a point in your life where it’s a necessity, and then one day, you wake up, and you simply don’t need the coverage anymore.

Let’s say you’re 65, all your bills are paid off, and there’s no one depending on you for financial support, then life insurance may not be needed. Remember, life insurance isn’t for you; it’s for your family. If you don’t want your family having to worry about paying off the rest of your house, your car, paying necessary bills, putting food on the table, your kid’s college getting paid off, etc., then having life insurance might be a good idea. On the other hand, if these are things you don’t have to worry about, then life insurance might be pointless.

However, let’s say you’re in great health; you’re 65 but haven’t paid off all your bills. Using VGLI might be a financial burden because it’s considerably more expensive than getting life insurance through someone else. If you’re 70 or older, your premium rate will also increase. But, if you still have bills and your family is still depending on you for support, again, life insurance may be necessary.

Now, let’s say you did your 20 years—maybe more, maybe less—in the military, you got out, you’re 40 years old, have one kid in middle school, two kids in college, you just purchased a new home, and your spouse stays at home as a result of a physical handicap. In a scenario like this, you are the breadwinner; if you were to pass away, your living spouse would not be able to pay the mortgage, keep food on the table, keep your kids in college, or provide other essentials for him or herself and your kid who just started the 6th grade. This isn’t a scenario any of us wants to picture, but it is always a possibility. This is why life insurance is important. If you want to make sure your family is provided for in your death, life insurance is there to make sure that happens.

Should I get VGLI

After you’ve answered the question about needing life insurance, you’re left wondering who to get it from. Should you get coverage under VGLI? The answer again, it depends. Have you sustained considerable health issues as a result of your service, or are you in great health? Do you smoke, or no? Are you over 60? How you answer these questions can increase or decrease your monthly payment when it comes to life insurance, and sadly, it can increase your chances of not getting the coverage you need.

However, VGLI can make things a little easier. For example, let’s say you did sustain considerable health issues while you were serving. With VGLI, as long as you apply for their life insurance within 1 year and 120 days of separation from the military and you were discharged with anything other than dishonorable, you qualify. This coverage is called term life insurance, meaning you can increase or decrease your coverage every 5 years. The only qualification is that you be a qualifying veteran; it doesn’t matter your health. Your age is also the only determining factor when it comes to your monthly premium, not your gender, not your health, not even if you’re a smoker.

Unlike some insurance companies, which require you to get a physical, provide medical documentation, and then determine the price based on age, gender, medical history, smoking history, and your physical results, VGLI won’t require a deep look into your lifestyle as much, at least not if you apply within 240 days of separation—after this, you’ll have to answer questions about your health.

Not so sure about life insurance through the VA? Check out some of these top life insurance companies here.

How much does VGLI cost?

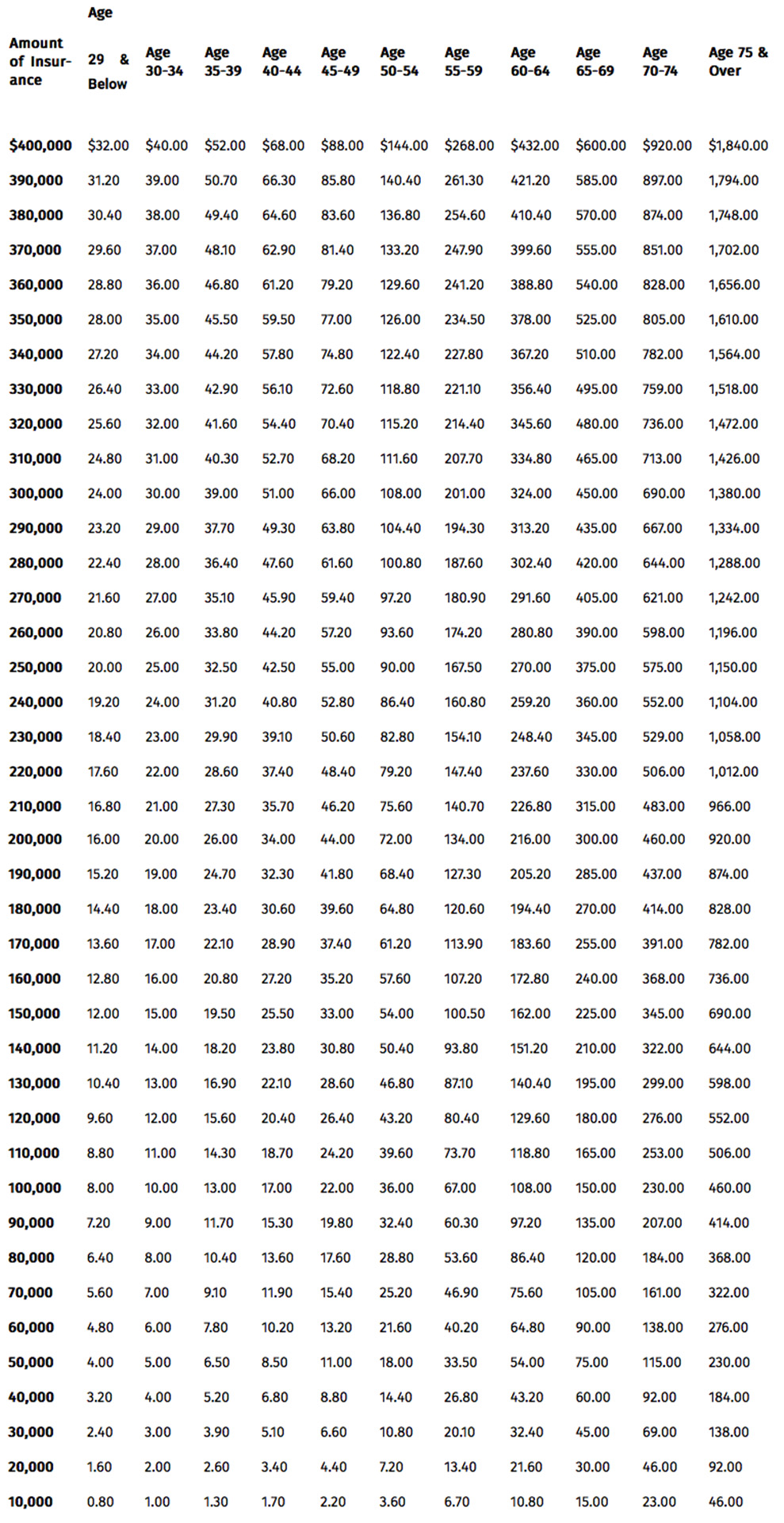

Below is the list, per the VA of cost per amount of coverage, based on age:

| Amount of Insurance | Age 29 & Below | Age 30-34 | Age 35-39 | Age 40-44 | Age 45-49 | Age 50-54 | Age 55-59 | Age 60-64 | Age 65-69 | Age 70-74 | Age 75 & Over |

| $400,000 | $32.00 | $40.00 | $52.00 | $68.00 | $88.00 | $144.00 | $268.00 | $432.00 | $600.00 | $920.00 | $1,840.00 |

| 390,000 | 31.20 | 39.00 | 50.70 | 66.30 | 85.80 | 140.40 | 261.30 | 421.20 | 585.00 | 897.00 | 1,794.00 |

| 380,000 | 30.40 | 38.00 | 49.40 | 64.60 | 83.60 | 136.80 | 254.60 | 410.40 | 570.00 | 874.00 | 1,748.00 |

| 370,000 | 29.60 | 37.00 | 48.10 | 62.90 | 81.40 | 133.20 | 247.90 | 399.60 | 555.00 | 851.00 | 1,702.00 |

| 360,000 | 28.80 | 36.00 | 46.80 | 61.20 | 79.20 | 129.60 | 241.20 | 388.80 | 540.00 | 828.00 | 1,656.00 |

| 350,000 | 28.00 | 35.00 | 45.50 | 59.50 | 77.00 | 126.00 | 234.50 | 378.00 | 525.00 | 805.00 | 1,610.00 |

| 340,000 | 27.20 | 34.00 | 44.20 | 57.80 | 74.80 | 122.40 | 227.80 | 367.20 | 510.00 | 782.00 | 1,564.00 |

| 330,000 | 26.40 | 33.00 | 42.90 | 56.10 | 72.60 | 118.80 | 221.10 | 356.40 | 495.00 | 759.00 | 1,518.00 |

| 320,000 | 25.60 | 32.00 | 41.60 | 54.40 | 70.40 | 115.20 | 214.40 | 345.60 | 480.00 | 736.00 | 1,472.00 |

| 310,000 | 24.80 | 31.00 | 40.30 | 52.70 | 68.20 | 111.60 | 207.70 | 334.80 | 465.00 | 713.00 | 1,426.00 |

| 300,000 | 24.00 | 30.00 | 39.00 | 51.00 | 66.00 | 108.00 | 201.00 | 324.00 | 450.00 | 690.00 | 1,380.00 |

| 290,000 | 23.20 | 29.00 | 37.70 | 49.30 | 63.80 | 104.40 | 194.30 | 313.20 | 435.00 | 667.00 | 1,334.00 |

| 280,000 | 22.40 | 28.00 | 36.40 | 47.60 | 61.60 | 100.80 | 187.60 | 302.40 | 420.00 | 644.00 | 1,288.00 |

| 270,000 | 21.60 | 27.00 | 35.10 | 45.90 | 59.40 | 97.20 | 180.90 | 291.60 | 405.00 | 621.00 | 1,242.00 |

| 260,000 | 20.80 | 26.00 | 33.80 | 44.20 | 57.20 | 93.60 | 174.20 | 280.80 | 390.00 | 598.00 | 1,196.00 |

| 250,000 | 20.00 | 25.00 | 32.50 | 42.50 | 55.00 | 90.00 | 167.50 | 270.00 | 375.00 | 575.00 | 1,150.00 |

| 240,000 | 19.20 | 24.00 | 31.20 | 40.80 | 52.80 | 86.40 | 160.80 | 259.20 | 360.00 | 552.00 | 1,104.00 |

| 230,000 | 18.40 | 23.00 | 29.90 | 39.10 | 50.60 | 82.80 | 154.10 | 248.40 | 345.00 | 529.00 | 1,058.00 |

| 220,000 | 17.60 | 22.00 | 28.60 | 37.40 | 48.40 | 79.20 | 147.40 | 237.60 | 330.00 | 506.00 | 1,012.00 |

| 210,000 | 16.80 | 21.00 | 27.30 | 35.70 | 46.20 | 75.60 | 140.70 | 226.80 | 315.00 | 483.00 | 966.00 |

| 200,000 | 16.00 | 20.00 | 26.00 | 34.00 | 44.00 | 72.00 | 134.00 | 216.00 | 300.00 | 460.00 | 920.00 |

| 190,000 | 15.20 | 19.00 | 24.70 | 32.30 | 41.80 | 68.40 | 127.30 | 205.20 | 285.00 | 437.00 | 874.00 |

| 180,000 | 14.40 | 18.00 | 23.40 | 30.60 | 39.60 | 64.80 | 120.60 | 194.40 | 270.00 | 414.00 | 828.00 |

| 170,000 | 13.60 | 17.00 | 22.10 | 28.90 | 37.40 | 61.20 | 113.90 | 183.60 | 255.00 | 391.00 | 782.00 |

| 160,000 | 12.80 | 16.00 | 20.80 | 27.20 | 35.20 | 57.60 | 107.20 | 172.80 | 240.00 | 368.00 | 736.00 |

| 150,000 | 12.00 | 15.00 | 19.50 | 25.50 | 33.00 | 54.00 | 100.50 | 162.00 | 225.00 | 345.00 | 690.00 |

| 140,000 | 11.20 | 14.00 | 18.20 | 23.80 | 30.80 | 50.40 | 93.80 | 151.20 | 210.00 | 322.00 | 644.00 |

| 130,000 | 10.40 | 13.00 | 16.90 | 22.10 | 28.60 | 46.80 | 87.10 | 140.40 | 195.00 | 299.00 | 598.00 |

| 120,000 | 9.60 | 12.00 | 15.60 | 20.40 | 26.40 | 43.20 | 80.40 | 129.60 | 180.00 | 276.00 | 552.00 |

| 110,000 | 8.80 | 11.00 | 14.30 | 18.70 | 24.20 | 39.60 | 73.70 | 118.80 | 165.00 | 253.00 | 506.00 |

| 100,000 | 8.00 | 10.00 | 13.00 | 17.00 | 22.00 | 36.00 | 67.00 | 108.00 | 150.00 | 230.00 | 460.00 |

| 90,000 | 7.20 | 9.00 | 11.70 | 15.30 | 19.80 | 32.40 | 60.30 | 97.20 | 135.00 | 207.00 | 414.00 |

| 80,000 | 6.40 | 8.00 | 10.40 | 13.60 | 17.60 | 28.80 | 53.60 | 86.40 | 120.00 | 184.00 | 368.00 |

| 70,000 | 5.60 | 7.00 | 9.10 | 11.90 | 15.40 | 25.20 | 46.90 | 75.60 | 105.00 | 161.00 | 322.00 |

| 60,000 | 4.80 | 6.00 | 7.80 | 10.20 | 13.20 | 21.60 | 40.20 | 64.80 | 90.00 | 138.00 | 276.00 |

| 50,000 | 4.00 | 5.00 | 6.50 | 8.50 | 11.00 | 18.00 | 33.50 | 54.00 | 75.00 | 115.00 | 230.00 |

| 40,000 | 3.20 | 4.00 | 5.20 | 6.80 | 8.80 | 14.40 | 26.80 | 43.20 | 60.00 | 92.00 | 184.00 |

| 30,000 | 2.40 | 3.00 | 3.90 | 5.10 | 6.60 | 10.80 | 20.10 | 32.40 | 45.00 | 69.00 | 138.00 |

| 20,000 | 1.60 | 2.00 | 2.60 | 3.40 | 4.40 | 7.20 | 13.40 | 21.60 | 30.00 | 46.00 | 92.00 |

| 10,000 | 0.80 | 1.00 | 1.30 | 1.70 | 2.20 | 3.60 | 6.70 | 10.80 | 15.00 | 23.00 | 46.00 |

Why does the cost of VGLI Increase Drastically at age 75?

There are actually a few reasons VGLI increases so drastically, especially at age 75. The main answer is, the likelihood of you passing during your coverage has increased drastically as well. Just as bad health increases your chances of death, so does age. And if an insurance company is expecting to payout, they’re going to raise the cost of coverage to help ease their own burden. A second reason is that you aren’t required to take a physical exam. Because it’s not a requirement, it means they are covering any and all qualifying veterans, and that means their chances of them paying out, in general, are much higher.

Therefore, if you want a reasonable price on life insurance at an older age, your best option is to go with a provider who requires a physical exam—assuming you’re in good health. This is because they don’t cover just anyone. By covering only people in a higher bracket of health, they don’t have to worry about paying out as often, meaning they can afford lower premium rates. So, if you don’t smoke (because smokers pay more) and you aren’t out there doing high-risk activities (because you’ll pay more there, too), then an option outside of VGLI might be a better choice.

Is VGLI Worth the Price

The price of life insurance can be a reasonable one, especially if you’re young and in good health. But, where you might see a bit of concern is when you reach 60, at least under VGLI terms, in which case the price may seem completely unreasonable.

Depending on your age and health, the price of life insurance through most providers and VGLI can be competitive. Now, this doesn’t mean you can’t find insurance at a lower price. The real advantage comes if you have health issues, you’re a smoker, or you can’t get insured elsewhere. Once you’re over 60, the prices raise considerably, and the competitive part goes out the window, especially if you’re over 75. Again, this is a good choice if you can’t get life insurance elsewhere because of your current health condition. If you can get $400,00 worth of coverage at 75 years of age for under $1,840/month, then it’s probably a good idea to look elsewhere. Again, make sure you need life insurance, and make sure you need the amount of coverage you’re paying for. If you don’t have $400,000 worth of expenses and no one is relying on you for financial support, then maybe you don’t need $400,000 worth of coverage. Maybe, $10,000 is all you need. So, do the math, select the amount of coverage that makes sense to you, and then decide if the price is worth it.

Pros and Cons of VGLI

Pros

- Cost-effective for the younger generation of veterans, especially if in poor health

- The older generation of veterans in poor health are eligible, even when most companies won’t provide coverage

- No proof of good health required if applied for within 240 days of separation

- You can increase your coverage by $25,000 every 5 years, up to $400,000

Cons

- Expensive for the older generation of veterans in good health

- Doesn’t require a physical exam; therefore lower prices can be found with other providers

- Not always the best option if you’re in excellent health

- You can only enroll up to the amount of life insurance you were covered for under SGLI (after 5 years, you can increase the amount)

How to Sign-Up for VGLI

There are three different ways to sign-up for VGLI. The fastest way to do this is online. Simply go to Prudential or eBenefits’ online VGLI application. There will be step-by-step instruction through both platforms. If you’d rather not apply online, you can also print out the application on the VA’s website, fill it out, and mail it to:

OSGLI

PO Box 41618

Philadelphia, PA 19176-1473

Again, ensure you apply for VGLI no more than 1 year and 120 days after separation and no more than 240 days after discharge if you want to apply without having to answer any medical/health-related questions. If you apply after the 240-day mark, your health will be considered in determining your coverage, which means there’s a chance you could be left without an option of utilizing VGLI.

How to Cancel VGLI

Okay, we did quite a bit of searching to find the answer to this—maybe more than we’d like to admit—and finally found the answer. Or at least we thought we did, maybe? Maybe not.

According to the VA’s website—which is a terrible place to find anything—a servicer must submit a cancelation notice. And no, the VA didn’t specify as to what a servicer is. But whatever they are, they’ll be submitting title documents and insurance policies directly to the VA’s property management contractor. Okay—we aren’t really sure what this means, so here, we’ll put what they wrote in quotes and let you decipher this code.

“The servicer training course states the servicer has to submit insurance cancellation notices. How are these documents going to be submitted?

VA requires that title documents and insurance policies be submitted directly to VA’s property management contractor when you transfer custody of a property to VA. An insurance cancellation notice may be submitted in lieu of an insurance policy.”

Well, alright then, if that’s not written in plain English… Yes, that was sarcasm.

We’re pretty sure someone mixed up the instructions for canceling VGLI coverage because we aren’t too sure as to why you’d be transferring custody of a property to the VA in this case.

Okay, okay…so maybe we didn’t get the answer to this one by simply looking at the VA’s website. But, lucky for you, we went ahead and called them directly—you know, so you wouldn’t have to wait on someone to answer the phone in 45 minutes to an hour.

This is what we got:

- You can cancel your VGLI coverage at anytime

- You do not have to wait until hitting the 5-year mark to determine whether to keep your coverage or cancel it

- There are no fees for canceling

- You can be covered under SGLI as an active reservist and use VGLI when you are not on orders (yes, you can be covered under both, but the payout will not exceed $400,000)

- All you have to do to cancel your policy is call them—counting the automation; it took us about 2 minutes to get through to a real person (we called at 1538 EST).

Other Varieties of Insurance through the VA Include

The VA actually offers a variety of life insurance options. There’s the Servicemembers’ Group Life Insurance Traumatic Injury Protection or (TSGLI), which is available to anyone who’s serving with the SGLI, who has also received a traumatic injury. This includes all traumatic injuries, including those as a result of combat. It is meant to help cover the service member while they recover from their injuries.

If you were released from active duty with a service-connected disability (including 0 percent), you’re in good health (with an exception to your service-connected rating), and you were discharged under other than dishonorable, you also might be eligible for Service-Disabled Veterans’ Insurance (S-DVI).

Veterans’ Group Life Insurance

To recap, VGLI is available for all qualifying veterans of any health condition (if you apply before 240 days). Depending on what your current health looks like and how old you are, should determine if this is a good option for you. If you’re older and have poor health, the steep prices of VGLI might be your only reasonable offer, especially if you can’t get covered elsewhere. Simply remember, if you want to apply without having to answer questions about your health, you must apply within 240 days of separation from the military. And if you aren’t supporting anyone financially and all your bills are paid off, you might not need life insurance at all.

TSGLI is also another option if you sustain a traumatic injury during your service. This life insurance will help until you have recovered from any traumatic injury and is only available to those currently using the SGLI—this should be automatic coverage.

S-DVI is available to any veteran with a service-connected disability, even if you have a 0 percent rating. The only exception is you need to have good health outside of anything service-connected. And like all benefits used with the VA, you have to be discharged under anything other than dishonorable.

Leave a Reply

Your email address will not be published. Required fields are marked *