What is a USAA Auto Loan?

USAA Auto Loans cover the cost of buying a new car that you can’t pay for in cash, allowing you to own a car without spending too much money and compromising your family. USAA Auto loans will ask for as little as 2.74% annual percentage rate (APR) for a new car and as low as 3.24% APR for a used car (as of the publication of this article). Most of the time, someone’s APR is based upon their credit score; the higher the credit score, the lower your interest. In this blog, we will explain what a credit score is, how to get a lower APR on a car loan, the process of getting a USAA auto loan, and how to insure your vehicle for your family’s protection.

What is a Credit Score?

Your credit score is a number that evaluates how you spend money and your trustworthiness with the major financial companies that offer the loans. For example, if you make $40,000 a year and spend $50,000 a year, you’ll be $10,000 in debt. Your credit score will be lower if you show that you can’t get out of debt and stay out of debt because the lender wants to make sure their company will get their money back. Your credit score will start at 300, and the highest score available is 850. My personal goal right now is to stay above 825, but you’re in the excellent category with anything more than a 720 for sure. Your credit score will be the largest factor in obtaining a loan and getting one with the lowest APR.

If you want to see the full rating system, go to this NerdWallet blog.

How Do I Improve My Credit Score?

I first learned about my credit score when I turned 20 years old and had to buy the first car that I couldn’t pay cash for, meaning it was above $2,000 in value. When I went to a Ford Dealership, they told my credit score was 350, and they couldn’t loan me a vehicle with that low of a credit score. Eventually, I had to have my father co-sign for the car for the bank to trust that I would pay it back. I focused my attention on 4 things to build my credit, which are:

- Focus on paying my loan back each month and doubling the payments some months to decrease the amount of interest I would pay.

- Use your credit card on everyday purchases, such as gas and the grocery store, and pay off the credit card after a couple weeks. Just make sure to not put more than 10% of the credit limit if that’s possible for you.

- Do your best to avoid hard-credit checks by banks and businesses, since these checks can actually hurt your credit score. The way you do this only applies for loans that you must have (car, house), everything else should be paid for in cash. If I want something that I can’t pay cash for, I save money from every paycheck until I can pay cash for that item, such as the Sleep Number Bed that I always wanted(totally worth it!). Avoid putting items on your credit card that you can’t pay off quickly, such as TV’s dishwashers, couches, and hunting gear.

- Nobody should need more than 1 credit card unless you’re a business owner or travel for business. Every time you apply for a credit card, they run a hard-check on your credit score, which causes your score to drop, and sometimes drastically.

*Do You have USAA Car Insurance? If not, read this blog to compare your current insurance with USAA.

What Is APR?

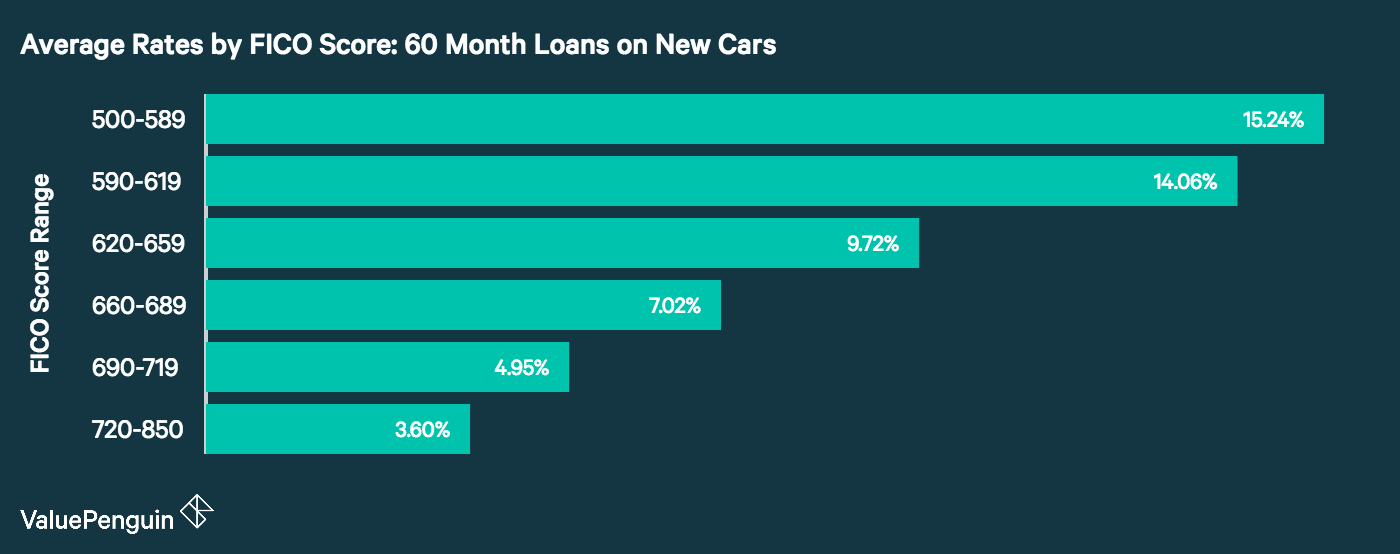

Annual percentage rate (APR) is the amount of money per year that you pay back to a lender in either a car or home loan. APR is impacted by your credit score, so be careful to follow the recommendations on how to improve your credit score. If you have a credit score of 720 or higher, you have the best chance at getting the APR that you want, which according to Value Penguin, averages out to a 3.60% FICO score. Your APR rate could end up saving you thousands of dollars by the end of your loan if you use your credit card responsibly. For example, buying a used car with a 3.24% APR will cost you $2,110.00 if you borrow $25,000. On the other hand, if your credit score is less than 590, you will pay close to 15.24%, which will cost about $10,874.14. You could end up paying more than double on the amount of interest you pay if you have bad credit.

Why You Should Get Your Auto Loan With USAA

For those of us that are qualified for the services of USAA, there is no point in not taking advantage of these services when you get the chance. I will be the first to admit that I don’t like everything about USAA and get very frustrated with their customer service, but the Auto Loan service is the best. If you are not aware of any problems or issues reported at USAA, I urge you to read this blog. However, the simplicity of the USAA Auto Loan service is so incredible that you won’t believe how easy they make it. There are many reasons to get your loan with USAA, but let us focus on the most important reasons.

| Reasons to Get a Loan With USAA | |

| No Hidden Cost | Don’t do all your research and financial planning to be surprised at the end of the deal with extra processing fees and taxes. Everything is upfront, and a price is attached to every service they provide with no acronyms that we don’t understand, just to take money from us. |

| Lease Buyout | Many people lease vehicles for different reasons, some have to do with convenience, and some have to do with commitment issues. I know I thought about leasing a Tesla Model 3 to test it out for a few months and see if I like it enough to commit to it, so no judgment if you lease a vehicle. The one concern with leasing a vehicle is putting money into a car that you don’t keep seems like a waste of money, much in the same way renting an apartment is over owning a house. With USAA, you don’t have to worry about that because they will help you buy the vehicle after your lease is up. |

| Specialized Disabled Vehicle Loans | No other company in the country is as in tune with the needs and issues affecting the Veteran community, such as USAA does. If you’re looking for a vehicle with specialized equipment for a wheelchair lift or accommodation, USAA offers special discounts on those loans. Wheelchair accessible vehicles can cost a ton, so being able to get the accommodations you need will be instrumental in living your best life. |

| No Prepayment Penalty | Some loan companies charge an extra fee for paying off your loan earlier than the scheduled time because they know they’ll lose out on interest. USAA doesn’t charge for paying off loans early, regardless if you lose out on interest or not. I know this very well because my two loans were paid off early, and I received no penalty for it. |

| Flexibility | Having the flexibility to choose who you buy your car from is the American thing to do, and USAA encourages you to buy from whoever you want. You’ll get a little higher rate if you don’t use the USAA Car Buying Service, but you get that choice. |

| USAA Car Buying Service | The USAA Car Buying Service will get you a lower rate on your APR because it takes USAA less work to do everything in house than it does to pay off an independent seller. |

| Payment Deferment Options | With the increase in natural disasters around the world, you could lose your car to a flood, tornado, hail storm, or hurricane. If you have a USAA loan, they will give you extra time to pay back the loan since they understand your car was just destroyed by mother nature, and there is nothing you could do about it. |

| Credit Decisions | When you call USAA to set request a credit check and see what you’re qualified for, you could know everything you’re qualified for within a few minutes. |

*If you’re not a homeowner, I strongly consider Renters Insurance to protect your most expensive belongings:

How Do I Get a USAA Auto Loan?

To ensure the loan process goes as quickly and smoothly as possible, use this time to get your paperwork and financial information together. You should know exactly how much cash you want to put down and how much you want to loan from the bank. Also, consider how much your household spends versus makes per month, so you don’t compromise your family. If you’re trading a vehicle, do your absolute best to get that vehicle paid off in full before the trade-in date, and you’ll have significantly less stress during the trade process. Once you have all your information ready and have done your research and math, click here, and in 5 minutes, you could be approved for an auto loan.

*If you’re looking for a car, the USAA Car Buying Service is the best place to start for USAA members.

Where DO I Start?

- Your employer’s name

- Income from all sources

- Calculate the full amount you would need to borrow

- If you are trading in a vehicle, your current monthly loan payment amount

- If you are purchasing a vehicle, remember to consider the cost of your vehicle plus sales tax, title, license, and optional warranties

Conclusion

A USAA Auto Loan is a difficult decision that has many financial implications, both good and bad. That’s why it’s so important to conduct your research. Just like anything in our lives, the work you put into reading this blog and other informative blogs will literally pay off in the end. In my opinion, this service is well worth the continued investment with USAA. I have found to have significantly less stress when I have used my USAA Auto Loans and will encourage any USAA Member to give it a try.

Leave a Reply

Your email address will not be published. Required fields are marked *